Pawn loan - Information

Everything you need to know to understand our concept

What is a pawn loan?

A pawn loan is just a loan against collateral. The bank does it in houses, we do it in objects.

When you pledge an item, you are actually pledging the item as collateral for a short-term loan. We offer you a certain amount (based on the value of the item) under the agreement that you repay the money within a certain time frame. We keep your item in a safe place for the duration of the loan. Once you have repaid all amounts owed (plus interest) within the agreed time frame, you will receive your item back. If you do not repay the loan, we can sell the item to recover any losses.

Understand our pawn loan,

in under 1 minute

How does a pawn loan work? - What does it cost and how?

To get a pawn loan you need to send pictures of your item to us, within a few hours you will receive a loan offer.

If you find the offer attractive, you accept and make a submission agreement. You then go to one of PANTSAT.DK’s physical stores in Copenhagen or Aarhus, where you sign a contract and hand in the valuables for security. It is then stored in one of their secured stores.

You get paid the money right away – sometimes the authenticity of the item has to be verified first, for example with designer bags or expensive watches, and then the money is paid out shortly after.

You can see our interest rate table here and calculate what it costs to have a pawn loan. An example is if you borrow 5,000 kroner it costs 225 kroner a month until you repurchase your item again.

A mortgage loan is super easy to maintain and you can always extend your contract by paying the cost of an extra month. If you borrow money from us, you can always choose to repurchase your valuables at any time during your contract and you only pay for the number of days you have had the loan.

There is thus no binding period or termination fee. This creates great flexibility for customers and there are no hidden fees.

What items can you pawn?

- Examples

-

Art

Art

-

Bikes

Bikes

-

Cars and Motorbikes

Cars and Motorbikes

-

Electronic

Electronic

-

Furniture, Lamps And Other Interior

Furniture, Lamps And Other Interior

-

Jewelry

Jewelry

-

Vintage cars

Vintage cars

-

Wine, Champagne And Spirits

Wine, Champagne And Spirits

-

Other items

Other items

-

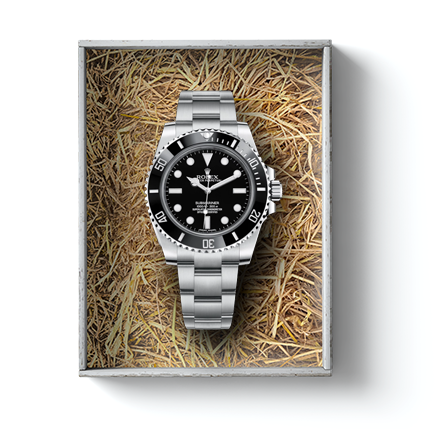

Watches

Watches

-

Designer bags

Designer bags

Art

Do you have a painting or lithograph hanging on your wall that you don’t need right now? Or maybe you have a valuable sculpture or Chinese vase that you would like to do for a period of time instead of raising money to fund other things? Then you can sell your artwork to us, receive a cash payment, and buy the artwork back again at a later date.

You can sell a wide range of original artwork such as paintings, lithographs, sculptures and photographs to us. It can be, for example, a painting by Hornsleth, Olaf Storø, Michael Kvium, Hans Scherfig, P. S. Krøyer, Per Kirkeby or Christen Kjøkes.

Click here to read more about the process of borrowing money by selling your artwork to us and repurchasing it at a later date.

Bikes

Do you have a valuable bike that you won’t need for the next while? Then you can advantageously sell it to us and buy it back when you need it.

You can sell a wide range of bikes to us. For example, it can be a racing bike, a mountain bike, a Christiania cargo bike or an electric bike. You can either hand in custom built bikes, or bikes of well-known brands such as Bianchi, Cannondale, Cervelo, Giant, Pinarello, S-Works, Specialized, Trek and Willer.

Click here to read more about the process of borrowing money by selling your bike to us and repurchasing it at a later date.

Cars and Motorbikes

If you can do without your motorcycle or your car for a while, we can offer you a payment with security in the vehicle. In practice, you sell your vehicle to us, after which we safely store it for an agreed period until you buy it back.

We accept a wide range of brands. For motorcycles, for example, it could be a Harley Davidson, Honda, Kawasaki, Yamaha, BMW, Ducati, Triumph and many others. For cars, most brands also have an interest. For example, it could be a BMW, Mercedes, Audi, VW, Renault, Nissan, Toyota, Ford and many others.

In principle, we accept all vehicles as long as they are of sufficient value and there are no existing liabilities in the car (eg from a car loan).

Click here to read more about the process of borrowing money by selling your motorcycle or car to us and repurchasing it at a later date.

Electronic

Do you have more electronics than you need? It can be a camera, a pair of B&O speakers or headsets, an iPhone, a Samsung Galaxy or a MacBook. While some electronics are rapidly declining in value, however, some brands and products hold their value relatively well and can be very valuable at the same time.

Do you have an electronics product from Apple, Bang & Olufsen, Bose, Leica, Nikon, Samsung or Sonos, for example, and would you like to exchange it for a cash payment for a shorter period? Then you can sell it to us and buy it back at a later date.

Click here to read more about the process of borrowing money by selling your electronics to us and repurchasing it at a later date point in time.

Furniture, Lamps And Other Interior

Denmark is known throughout the world for our design, style and architecture. Over time, Danish designers have designed furniture, lamps and other interiors that have become a permanent part of Danish homes. Do you have a design classic yourself that you might not get used to much? Then you can sell it to us for cash and buy it back at a later date when you need it again.

It could be, for example, a chair designed by Børge Mogensen or Hans J. Wegner, or perhaps a Poul Henningsen lamp. Other obvious designers and design houses could be Arne Jacobsen, Kaj Bojesen, Louis Poulsen, Mogens Koch, Royal Copenhagen and Vipp. We accept most design interiors, whether Danish or foreign designers are behind.

Click here to read more about the process of borrowing money by selling your design interior to us and repurchase it at a later date.

Jewelry

Do you have valuable jewelry lying in the drawer that you are not currently using and would you like to exchange it for money for a shorter period? Then you can sell the jewelry to us and buy it back at a later date.

For example, it could be a pair of gold, silver or platinum earrings from a well-known designer such as BVLGari, Cartier, Georg Jensen, Pandora or Tiffany Co. It can also be a custom-made ring with diamonds or other precious gems in it.

>

Click here to read more about the process of borrowing money by selling your jewelry to us and repurchasing them at a later date point in time. You can also always get a non-binding assessment of your jewelry

Vintage cars

If you have a vintage car, you can hand it over to us and get a cash payment. Veteran cars have become popular and widely used in Denmark. If you have a standing yourself, you can use it as collateral for a payment from us. You take advantage of the free value of your vintage car, which is equivalent to getting a home loan – here it is just your vintage car, we take security and not your home.

When you hand in your veteran car to us, the veteran car retains its license plates as these can also be special and important to you (the car will not be registered). We place the car in an indoor secured garage with alarm and surveillance – so it is in good hands while being mortgaged.

We accept a wide range of brands. For example, it could be Triumph, Mercedes, Porsche, MG, Jaguar, Austin and many others. As a starting point, we accept all vehicles as long as they are of sufficiently high value and there is no declared debt in the vehicle.

Wine, Champagne And Spirits

Do you have a good stock of wine, champagne and / or spirits? Maybe so big that you don’t get to drink it all, or maybe you shouldn’t drink it the next while? Then you can hand in your bottles to get a cash payment that you can use exactly as you wish. When you get thirsty again, you just buy the bottles back.

You are welcome to sell individual bottles of high value or a collection of flakes that together make up a significant value. For example, it could be 24 bottles of expensive red wine or three magnus champagne bottles.

Click here to read more about the process of borrowing money by selling your wine, champagne or liquor bottles to us and repurchasing them at a later date.

Other items

Do you have a valuables that do not fall into one of the categories mentioned? So contact us by chat, phone or email – we can together try to find a solution.

For example, it can be valuable items such as musical instruments, expensive porcelain, silverware, coins, or something else entirely.

Watches

Have you purchased or maybe inherited a valuable watch but need cash now? Then you can sell the watch to us and buy it back at a later date. We accept a wide range of watches: from fashion and style watches like Tissot and Montblanc to luxury watches like Rolex, Omega and Breitling.

In addition to watches from well-known brands such as Cartier, Hublot, IWC, Montblanc, TAG Heuer, Audemars Piguet and Patek Philippe, you also have the opportunity to sell custom-made watches and unique ones for us – for example, it can be an inherited pocket watch of precious precious metal.

Click here to read more about the process of borrowing money by selling your watch to us and repurchasing it at a later date.

Designer bags

The designer bag is a must have accessory for the stylish outfit. Many people even have several different designer bags to always have one that fits the occasion. Now you may have reached a point where you have a bag in excess and would rather have more money between your hands for a period of time. Then you can sell the bag to us and buy it back when you later want to go with it again.

You can sell valuable designer bags from brands such as Louis Vuitton, Chanel, Hermes, Alexander Wang, Bally, Burberry, Christian Dior, Coach, Mulberry, Prada and Versace to us.

Click here to read more about the process of borrowing money by selling your designer bag to us and repurchasing it at a later date.

What are the benefits of a pawn loan?

-

- It’s easy to get a loan: Because a pawn loan is based solely on the value of your item and not your income, expenses or credit history, all get a loan from PANTSAT.DK. Even if you are in RKI.

- Get the money right away: Getting a mortgage loan is quick and easy, most often you get the money in hand right away.

- You only pay per day: You can buy your item back at any time, you are not bound for a certain period of time, and you only pay for the days you borrowed the money.

- You can never owe money: If you do not repurchase your item, you will not be able to owe money afterwards. You will not be indebted.

- You can borrow large amounts: Because there is security in valuables, you can usually borrow very large amounts. At PANTSAT.DK you can borrow several million kroner.

- Discretion: When you go to PANTSAT.DK it is done with complete discretion. They offer to pick up items from customers with especially valuable items, or close the store if you wish. Of course, they also store all your information securely and confidentially.

What happens if you do not repurchase your item?

If you do not repay or extend the loan at the agreed time, your repayment right will lapse.

However, we always prefer that you get your item back, so if you want a reprieve or need some more time, please contact us.

You will not be charged any additional costs and you owe us no money. We thus send you neither for debt collection nor for RKI. Thus, you should not be afraid if you cannot, in anticipation, buy back your valuables.

Frequently asked questions about pawn loans

- Most asked question

- General about a pawn loan

- Assessment and payout

- Handing in, picking up and shipping

- Contract termination and repurchase

- Already a customer - Questions for your contract

Yes we do. We can often offer more in payment if you do not want the opportunity to buy your item back later.

Sign up for our chat and we can make a purchase offer for you.

A pawn loan is just a loan against collateral. The bank does it in houses, we do it in objects.

It works by handing in one or more items to us as collateral and you get a loan.

Write on our chat so we can assess your item and come up with a non-binding offer for you on a pawn loan.

You decide the maturity of your loan yourself.

When we enter into a loan agreement, it usually runs for 2-3 months, but it can easily be longer or shorter. There is no maturity on your loan, so you decide whether you want to borrow for 14 days, 1 month, 3 months, 9 months or a completely different maturity.

We generally accept all types of items as long as they have a value over DKK 2,000.

Write to us on the chat and get a free assessment of your item and a non-binding loan offer.

We pay a share of the value of your item – up to 80% of the value depending on the type of item.

Some types of items we can pay out more than others, for example. we can pay a very high share in gold, while it is lower for things that are difficult to assess as art.

Write to us on the chat and get a free assessment of your item and a non-binding offer on what you can get in loan

We always strive to pay as soon as possible.

With the vast majority of things you can get the money right away – once you have filed your items and we have signed the contract.

Some things require authenticity to be verified; eg. expensive watches and designer bags. With these items we get an affiliate expert to verify the item and then pay out. In most cases, this is done on the same day.

Yes you can, with smaller amounts.

With larger payouts, this is only done through bank – it is done with instant transfer so you have the money right away.

You can calculate costs in our loan calculator.

If you want to hear how much it costs for a specific loan, write to us for a tailor-made and free loan offer.

No – your item will not be used, displayed or removed from the secured warehouse while you have borrowed from us.

If you do not repay or extend the loan on time, your repayment right will lapse.

However, we always prefer that you get your item back, so if you want a reprieve or need some more time, please contact us.

You will not be charged any additional costs and you owe us no money. We thus send you neither for debt collection nor for RKI. Thus, you should not be afraid if you cannot, in anticipation, buy back your valuables.

We can lend to anyone, regardless of financial situation – we only look at to the value of the item, and we do not examine your personal finances. Therefore, it is not an obstacle if you are registered in RKI.

You can transfer money to us at:

MobilePay: 101038 (nofipa)

Bank Account: 0520-0000744638

Remember to enter your contract number when you transfer to us so that the money is registered correctly.

We sell things in different places – among others on DBA, Facebook, Lauritz, Chrono24, Vestiaire Collective, and through our network.

You can see most of our items for sale on these 2 profiles:

– https://www.dba.dk/saelger/privat/dba/403333

– https://www.dba.dk/saelger/privat/dba/6789661

Write to us if you want to be listed in our buyer’s directory.

Unfortunately, we are unable to accept cash payments. You can pay by card or bank transfer. If you have cash, you need to deposit it into a bank and then transfer it to us, or you can use a transfer service to receive the cash and transfer it directly to us.

A pawn loan is just a loan against collateral. The bank does it in houses, we do it in objects.

It works by handing in one or more items to us as collateral and you get a loan.

Write on our chat so we can assess your item and come up with a non-binding offer for you on a mortgage.

Everyone has the opportunity to become a customer of pantsat.dk.

Our requirements are simply:

– You have a valid ID

– You have an item of value that you can deliver to us as security.

Write to us on chat and get a non-binding loan offer.

If you have applied elsewhere for a regular loan and have been rejected, it is because your credit rating has been rejected.

At pantsat.dk we do not relate to your personal finances or situation – we only look at the item you can provide in security.

Write to us on the chat and see if we can help you.

We generally accept all types of items as long as they have a value over DKK 2,000.

Write to us on the chat and get a free assessment of your item and a non-binding loan offer.

We pay a share of the value of your item – up to 80% of the value depending on the type of item.

Some types of items we can pay out more than others, for example. we can pay a very high share in gold, while it is lower for things that are difficult to assess as art.

Write to us on the chat and get a free assessment of your item and a non-binding offer on what you can get in loan

We always strive to pay as soon as possible.

With the vast majority of things you can get the money right away – once you have filed your items and we have signed the contract.

Some things require authenticity to be verified; eg. expensive watches and designer bags. With these items we get an affiliate expert to verify the item and then pay out. In most cases, this is done on the same day.

The interest rate depends on how much you borrow – you can see more in our loan calculator.

The more you borrow, the lower the interest rate.

Our interest rate is as low as 2.95% on loans over DKK 15,000.

Yes.

We insure your item at the valuation value. We store your item in insured and security-approved premises.

No – your item will not be used, displayed or removed from the secured warehouse while you have borrowed from us.

No, we take security in items, which is why we don’t do a credit rating.

No you should not.

When you pledge, you do not personally pay for the loan, you place an item in collateral and therefore it is not necessary to make a credit assessment or examine your finances.

If you do not repay or extend the loan on time, your repayment right will lapse.

However, we always prefer that you get your item back, so if you want a reprieve or need some more time, please contact us.

You will not be charged any additional costs and you owe us no money. We thus send you neither for debt collection nor for RKI. Thus, you should not be afraid if you cannot, in anticipation, buy back your valuables.

There is no minimum or maximum term on the loan.

You can choose to pay off your loan the day after and pay only for 1 day interest. However, we have a minimum of DKK 250 which covers our administrative costs.

For longer loan maturity, you can extend your loan as long as you need. The only thing this requires is that you pay the interest on a continuous basis. When you pay the interest on an ongoing basis, the repurchase price does not increase on the item.

When a contract (your loan) expires, you can choose to extend it. You do this by paying for an extension.

An extension corresponds to the monthly interest rate. This also means that when you pay extensions on a regular basis you pay the interest rate so your repurchase price does not increase.

Yes, you can always extend the term by paying a month’s interest.

You can extend in 2 ways.

(1) Sign up for our automatic extension on MobilePay when you do this, the interest rate will also be lower for you as it eases our administrative burden.

(2) You can also extend normally by paying the extension on MobilePay, by bank transfer or come down to us and pay in cash.

You can easily repurchase your valuables before the contract expires. There is no charge for this, and if you repurchase the valuables before the contract expires, then the repurchase price will be lower than at the end of the contract (and thus cheaper for you).

E.g:

We have entered into a contract where you have been paid DKK 10,000, and can repurchase the valuable after 90 days for DKK 11,085 (this means that the repurchase price increases by about DKK 13.16 per day).

If you would like to repurchase your valuables after 70 days, this can be done for a repurchase price of DKK 10,921 (the repurchase price has increased by DKK 13.16 every day for 70 days).

There is no charge to repay the loan early.

Yes you can.

When you repay, the principal falls on your loan, and the current interest rate also decreases.

A pawn loan is fast, easy and straightforward.

A pawn loan is just a loan against collateral. The bank does it in houses, pantsat.dk does it in objects.

Some of the benefits of a mortgage loan are,

– We can lend to anyone, regardless of financial situation – we only relate to the value of the item, we do not examine your personal finances.

– We have the opportunity to pay off your loan on the same day.

– You cannot debt with a mortgage loan

– Mortgage loans are a cheap alternative to online loans and overdraft facilities at shorter maturities.

Write us the chat and get a non-binding loan offer.

We store your item in insured and safety approved premises.

We insure your item at the valuation value – so in the very unlikely and unfortunate situation that something should happen to your item, it is insured.

With very valuable items such as gold, jewelry and watches, they are stored in a bank box. With other items such as furniture in highly secured warehouse rooms, where moisture and temperature are carefully controlled.

No, there are not some who can.

Discretion and your personal data are incredibly important to us.

You can easily have other loans and still get a pawn loan with us.

We only deal with the item you are filing and not your finances.

If you submit a description and some pictures to us on the chat, we can assess the value of your item.

For the assessment, we look at what items similar to yours are sold for online – ie the market price.

We base ourselves on prices on public platforms such as DBA, Facebook, Chrono24 and more, as well as auctions like Lauritz.com and in addition our internal database and expert network.

Send us a description and some pictures for us on the chat and we will evaluate your item for you.

You can also use our form here on the website “Get an assessment” – it is free and non-binding.

We pay between 50-85% of the value of your item.

For most item types, we usually pay 50%, but if the item holds value over time, such as gold and rolex watches we can pay a larger share.

We always strive to pay as soon as possible.

With the vast majority of things you can get the money right away – once you have filed your items and we have signed the contract.

Some things require authenticity to be verified; eg. expensive watches and designer bags. With these items we get an affiliate expert to verify the item and then pay out. In most cases, this is done on the same day.

We pay the money with a bank transfer so you have the money in your bank account right away. It is also possible to pay the loan in cash.

Yes you can, with smaller amounts.

With larger payouts, this is only done through bank – it is done with instant transfer so you have the money right away.

With certain types of objects there are replica versions of them (ie counterfeit), which is why we get an area expert to verify authenticity.

These are item types such as watches, art, designer furniture and designer bags eg.

We have affiliate experts who verify the authenticity of your item

Unfortunately, we are unable to accept cash payments. You can pay by card or bank transfer. If you have cash, you need to deposit it into a bank and then transfer it to us, or you can use a transfer service to receive the cash and transfer it directly to us.

Yes, it must be filed in our store in Copenhagen or Aarhus.

It must be delivered in our store in Copenhagen on Store Kongensgade 59F or in Aarhus on Østergade 33 st th

We always recommend ordering time for the delivery of your item, as there is less likelihood of waiting for other customers. But it is not necessary

We store your item in insured and security-approved premises.

We insure your item at the valuation value – so in the very unlikely and unfortunate situation that something should happen to your item, it is insured.

With very valuable items such as gold, jewelry and watches, they are stored in a bank box. With other items such as furniture in highly secured warehouse rooms, where moisture and temperature are carefully controlled.

In some cases, we may pick up the item at your address. However, not all object types are possible where this is possible. We offer pick-up on payments over DKK 25,000.

Call or write to us to hear if we can pick up at your address.

At present, we only pick up near Copenhagen and Aarhus. But we can offer to pay to have it sent to us by mail.

Call or write to us at chat to order pickup for your item.

We offer pickup at larger loan amounts.

Yes, you can send your item by mail, we will gladly pay for the freight.

Yes, we mean it is.

If you want to send your items by mail we recommend GLS or Postnord.

Postnord offers to insure your packages, which is a good solution with higher value items.

Write to us on the chat and we can agree that we buy a package label for you.

Yes, we gladly pay for the freight of your item.

You can send your item by mail to our address.

Before sending, please send some pictures and description to our chat – we can in most cases give a rating on this background.

You get your item back by paying the buyback price

You can calculate costs in our loan calculator.

If you want to hear how much it costs for a specific loan, write to us for a tailor-made and free loan offer.

We are currently developing a customer portal where you can get an overview of your contracts and repurchase price.

Right now, you will see the purchase price reflected in the emails we send out.

If you would like to know your withdrawal price, you are also welcome to write to us on the chat.

If you do not repay or extend the loan at the agreed time, your repayment right will lapse.

However, we always prefer that you get your item back, so if you want a reprieve or need some more time, please contact us.

You will not be charged any additional costs and you owe us no money. We thus send you neither for debt collection nor for RKI. Thus, you should not be afraid if you cannot, in anticipation, buy back your valuables.

You can easily repurchase your valuables before the contract expires. There is no charge for this, and if you repurchase the valuables before the contract expires, then the repurchase price will be lower than at the end of the contract (and thus cheaper for you).

E.g:

We have entered into a contract where you have been paid DKK 10,000, and can repurchase the valuable after 90 days for DKK 11,085 (this means that the repurchase price increases by about DKK 13.16 per day).

If you would like to repurchase your valuables after 70 days, this can be done for a repurchase price of DKK 10,921 (the repurchase price has increased by DKK 13.16 every day for 70 days).

There is no charge to repay the loan early.

If the contract has expired and your item is not repurchased or extended, we will go out and sell it to cover the loan.

However, if it is just a matter of being delayed a little bit about. Of course the payment of the extension is perfectly ok – just call or write to us on the chat so we will get it listed and get the details agreed.

No, we don’t.

We always prefer that you get your item back, so even if a contract is over with a few days, we do not sell your items. Usually we say that if 10 days have passed after the contract has expired and we have not heard from you, we will put the item up for sale.

If you already know in advance that you cannot pay or extend on time, please contact us by phone or chat, we may be able to make a specific agreement with you.

You don’t even have to remember when your contract expires – We send reminders to you both by mail and sms when your contract is about to expire or if it has expired

Yes, you can extend your contract automatically. If you sign up for our mobile payment solution, it will automatically renew your contract if there is money in your account. In addition, you get a cheaper interest rate by signing up for auto renewal on mobile pay. Write or call to hear more

We are currently developing a customer portal where you can get an overview of your contracts and repurchase price.

Right now, you will see the purchase price reflected in the emails we send out.

If you would like to know your withdrawal price, you are also welcome to write to us on the chat.

Your monthly renewal premium is reflected in your contract.

Your extension will depend on what you have borrowed; down to 2.95% for larger loans.

If in doubt, write to us on the chat.

You pay off your loan by paying the repurchase price of your item. You can redeem by paying the money to our bank account or mobile payment. Write to us to hear what your buyback price is today.

Yes, you can always extend the term by paying a month’s interest.

You can extend in 2 ways:

(1) Sign up for our automatic renewal via MobilePay – when you do, interest rates will also be lower for you as it eases our administrative burden.

(2) You can also extend normally by depositing the extension on MobilePay, by bank transfer or coming down to us and paying in cash.

If you do not repay or extend the loan on time, your repayment right will lapse.

However, we always prefer that you get your item back, so if you want a reprieve or need some more time, please contact us.

You will not be charged any additional costs and you owe us no money. We neither initiate a debt collection process nor register you with RKI. Thus, you should not be afraid if you cannot buy back your valuables as planned.

It does not matter. We keep all contracts digitally. You can contact us on the chat, call us, send an email or visit us in our store to have a new copy sent to your email.

We always recommend booking time to pick up your item, as there is less likelihood of waiting for other customers. But it is not necessary

Yes you can.

When you repay, the principal falls on your loan, and the current interest rate also decreases.

You can easily repurchase your valuables before the contract expires. There is no charge for this, and if you repurchase the valuables before the contract expires, then the repurchase price will be lower than at the end of the contract (and thus cheaper for you). For example: We have entered into a contract where you have been paid DKK 10,000, and can repurchase the valuables after 90 days for DKK 11,085 (this means that the repurchase price increases by about DKK 13.16 per day). If you would like to repurchase your valuables after 70 days, this can be done for a repurchase price of DKK 10,921 (the repurchase price has increased by DKK 13.16 every day for 70 days). There is no charge.

Physical submission

Physical submission

Send by mail

Send by mail